Tax (Loss / Gain) Harvesting

What is Tax Harvesting?

Tax harvesting is a strategic AND legal method to reduce your tax liability, each year. There are two options available to you:

- Tax LOSS Harvesting

- Tax GAIN Harvesting

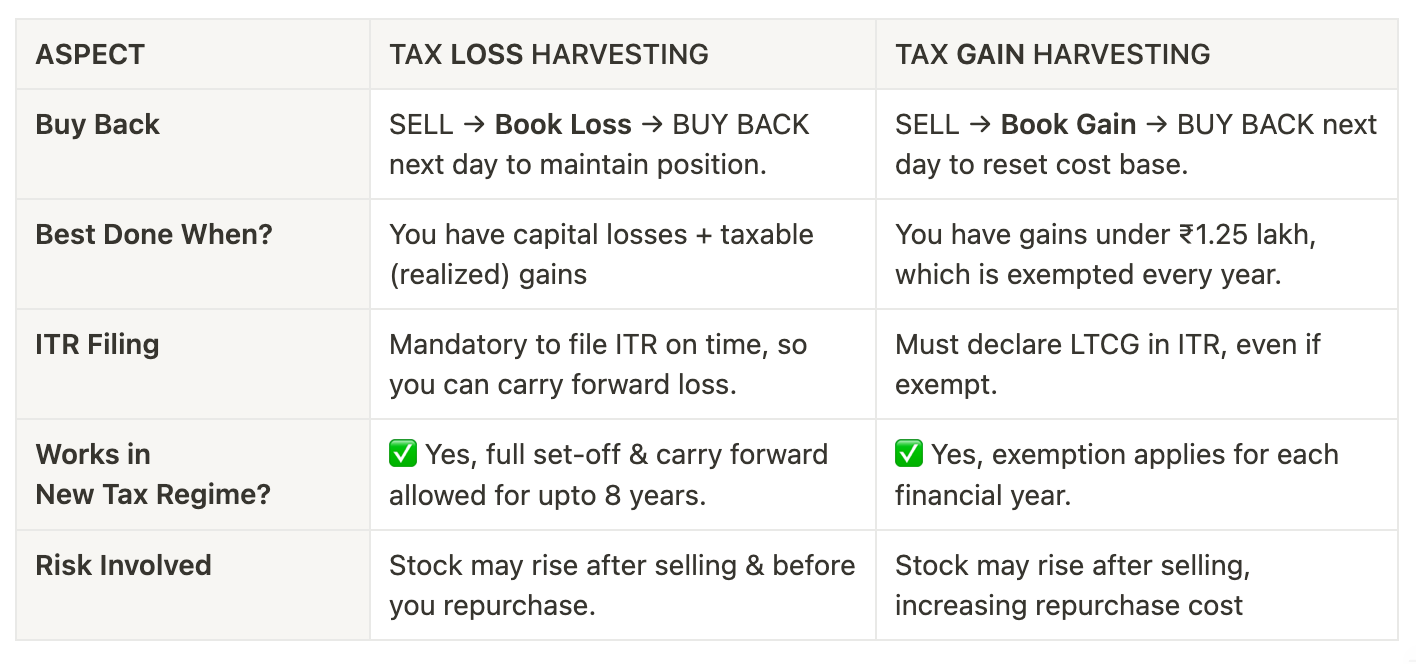

Tax LOSS Harvesting – instead of holding on to losing stocks, you can book a loss now, and use it to save tax.

Tax GAIN Harvesting – every year, if you have ₹1.25 lakhs of profit to book, you can realize it TAX-FREE! (who would say no to that!?)

What is the Deadline for Tax Harvesting?

Every year, before the 31st March of that Financial Year, you can do tax harvesting. Though we recommend you don't leave it to the last minute, instead mark your calendar in the month of February or the first two weeks of March for this.

So how is Tax Harvesting done?

Depending on what you're doing, whether it be tax loss harvesting or tax gain harvesting – here are the steps below (please consult with your tax advisor):

Tax Loss Harvesting

→ Identify Underperformers & SELL the mutual funds (or stocks) that are in a loss.

→ Use those losses to offset capital gains you have booked earlier. This reduces your tax liability. And the good thing is that you can carry forward capital losses and offset them against capital gains for up to 8 years.

Tax Gain Harvesting

→ SELL mutual funds (or stocks) with gains upto ₹1.25 lakh (which you are permitted as per IT Act). The capital gains up to ₹1.25 lakh is TAX-FREE.

→ BUY the same mutual funds (or stocks) back the next day – this will be treated like a fresh buy, on that day.

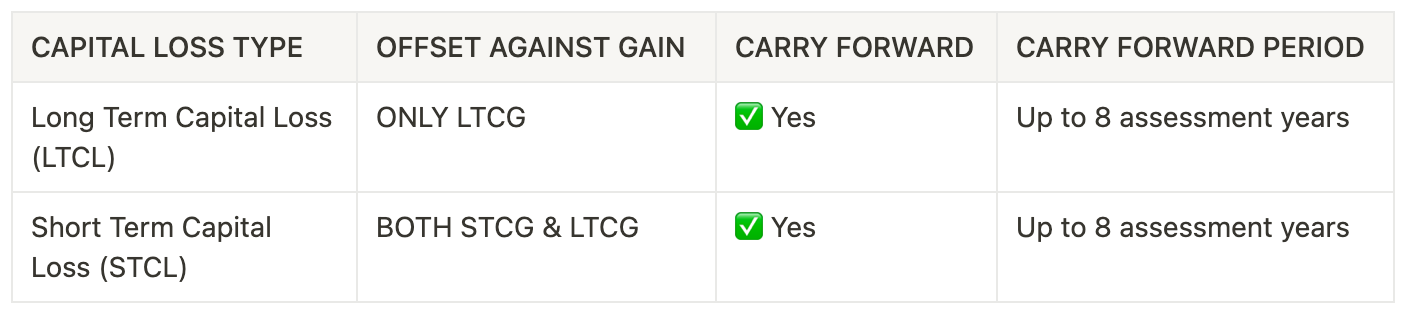

Note: Setting Off Capital Losses in Tax-Loss Harvesting

When setting (netting) off losses with tax-loss harvesting, you need to keep the following points in mind:

- Long Term Capital Loss (LTCL) can be set-off against →

- Long Term Capital Gain (LTCG).

- Short Term Capital Loss (STCL) can be set-off against →

- both Short Term Capital Gain (STCG) and/or Long Term Capital Gain (LTCG).

Keep In Mind: Be Careful

You should only BUY BACK the NEXT day, not the same day. If you buy back the same day, it will be treated as an "intraday" trade – and you will not receive any of the tax harvesting benefits.

Having the same amount of cash as you're selling already in your trading/bank account will be beneficial, otherwise you will have to wait for the cash to hit your account (which may take a day or two) before you can buy back mutual funds (or stocks). And because of this, the following point is important:

There is a possibility that the next day the price can go up. This is the drawback, and a matter of (bad) luck. It may go up by a bit sometimes, but given what we have seen in 2025 – it could also shoot up a few percentage points!

Summary

You can discuss the following as part of your tax planning process, with your tax accountant or advisor:

Member discussion